Tax planning is an activity that requires detailed analysis and careful selection of instruments. This is an annual activity but still neglected by large number of individuals. This negligence leads to inappropriate and hasty selection of instrument for tax planning and people make haphazard decision related to tax planning investments.

To take a better perspective of the options available for investment and how one can optimize the benefits, Dr. Prashant Dev Yadav, Faculty of Finance at SCMS-NOIDA, invited Mr. Balwant Jain, a tax expert, finance consultant, and regular panellist on various channels like CNBC Awaz, Zee business etc. to address the issue and enlighten the budding investors with insights.

The event started with Sumit Chawla, Deputy Head Finance Club, welcoming the Guest Speaker and all the listeners and inviting the backbone of the event, Dr. Prashant to say few words, followed by our esteemed Director Dr. K.P. Venugopala Rao, who addressed the students regarding the importance of Personal Finance in everyone’s life.

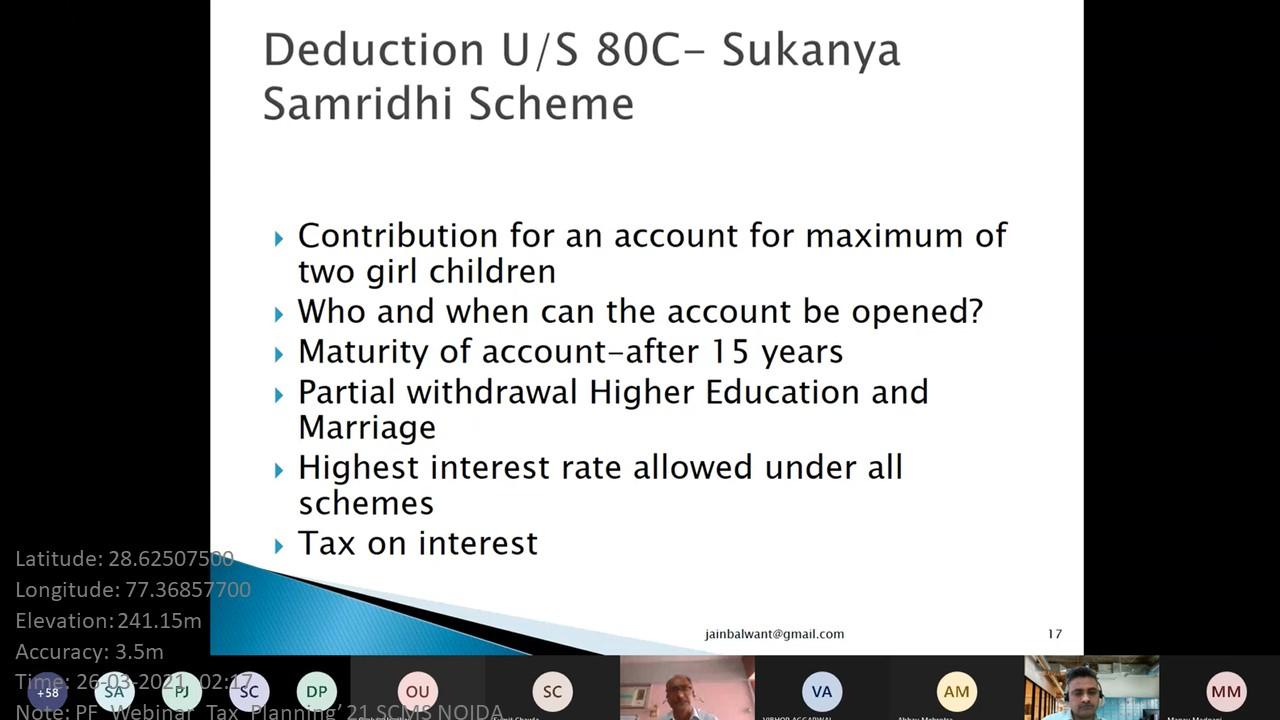

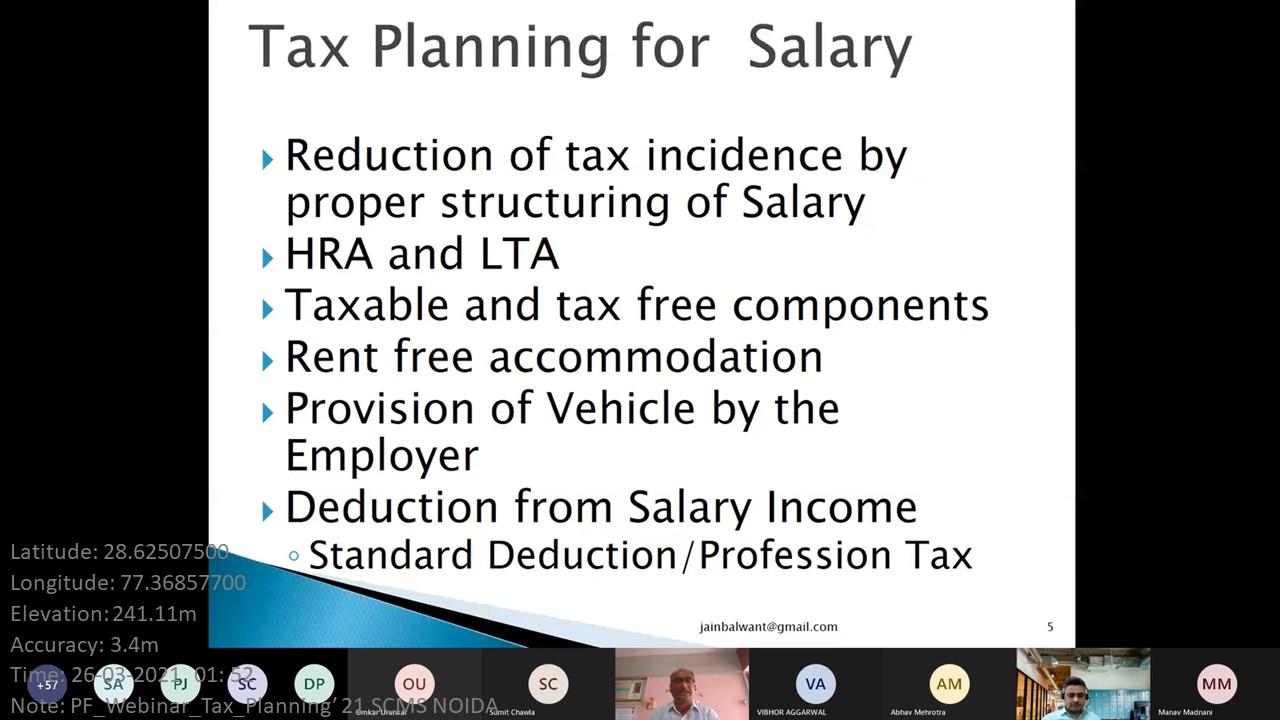

Then our guest speaker, Mr. Balwant Jain was invited to takeover the event. He started with explaining about various important aspects of Taxation in India and how we as individuals can plan our investments accordingly so that we can save as much tax as possible. He explained about various sections under Income Tax Act, 1961, under which we can claim various deductions, including section 80 CCC, 80CCD, 80C, 80D, 80DD. He explained thoroughly how we can plan the investments in various instruments like PPF, NPS, insurance products and how the Interests on loans such as home loans be used to claim deductions from income tax.

He also told how there are numerous investments instruments available, but the maximum deduction is up to a threshold limit of Rs. 1.5 Lakhs only. Following his presentation, there were various doubts and questions in the listeners which the speaker cleared through his apt explanations. This webinar had a great outcome for the students. They got a clear idea about importance of tax planning for investors, various instruments, and their benefits, 80 (C) and the opportunities available with this and visualize the benefit of tax planning for individuals to maximize the benefits. The session ended with Sumit Chawla giving vote of thanks to the speaker for sparing his time to enlighten our students.

The photographs of the event are: